Get your money from the IRS for damage to your home

Order your appraisal and get the data required to file a casualty loss claim with the IRS

Order now

Calculate Your Savings

3 EASY STEPS to provide you the necessary home appraisal to get additional tax money back fast.

Step 1

Order appraisal

Step 2

File a casualty loss with the IRS using the data from your report

Step 3

The IRS refunds your money

Loss After Disaster Appraisal Reports help homeowners file amended tax returns to get money fast.

We know after a disaster you need help right away. Victims are eligible for additional tax benefits that can be received right away. Use your LADAR to file IRS Form 4684 (Casualty Losses) as an amendment to the previous years tax return, and get money back fast.

What is a LADAR?

A Loss After Disaster Appraisal Report shows you the fair market value of your home before a disaster, the fair market value after, and your loss.

With our proprietary software, using data for homes in your area, we are able to calculate your loss without ever needing an inspection, allowing you to continue to focus on family and work.

How does it work?

We’ll run a valuation on your home prior to the disaster, taking into account conditions and comparable sales within your neighborhood. Then, using the guidelines set forth by FEMA and the army corps of engineers, in combination with the amount of damage to your home, we calculate the value of your home after the disaster.

The difference between these two numbers is your loss.

How can I use my LADAR?

“To figure the amount of your casualty and theft losses, you must generally determine the actual reduction in the FMV of lost or damaged property using a competent appraisal or the cost of repairs you actually make."

From the IRS

The information included in our report can help in a variety of ways. Most people use it to file a loss claim with the IRS, but the information can also be used for your own records, for insurance claims, and a variety of other things.

When used to file a Casualty form with the IRS, homeowners can potentially recover thousands of dollars through a tax refund.

IRS Form 4684, Casualties and Thefts, allows homeowners to add the loss of value of their home (minus any reimbursements) to their tax deduction. In order to use this form, you must show the fair market value (FMV) of your home before and after the loss.

Please reach out to a certified public accountant for additional information on how to use the IRS Form 4684, or view our FAQ.

Frequently Asked Questions

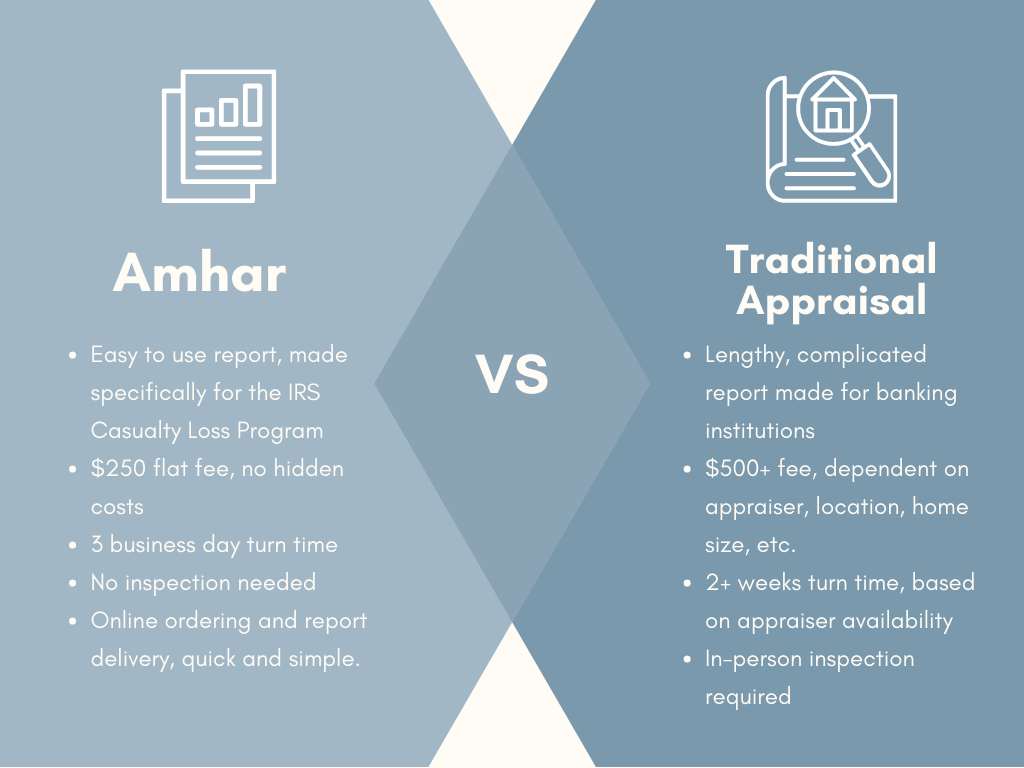

The Loss After Disaster Appraisal Report can only be ordered for homes within a federally declared disaster area. If you do not qualify for a LADAR, but would still like to determine the value of your property, we offer traditional appraisals at a discounted rate through our partnership with Arivs, a national appraisal management company.

The two main things needed are the value before the disaster, and after the disaster, to show the loss. These values can come from the Loss After Disaster Appraisal Report. You must also show any reimbursements (such as from insurance or FEMA).

Yes, any insurance proceeds will be deducted from your total loss, and any remaining loss is still deductible.

FEMA aid is handled the same way as insurance reimbursement.

We can run a LADAR on a manufactured home, but not a mobile home. If your home is manufactured but has a foundation, you can order like normal through our site. If you are concerned about your home qualifying, please reach out to us.

Only homes inside the declared disaster area qualify for the IRS Casualties form. As such, we can only complete valuations for homes within declared disaster counties. Through our partnership with Amhar, an inspector can visit your home and complete a manual valuation for an additional cost.

The loss can be carried forward for future tax years, until it is entirely used.